You can expect reasonable Redding, California mortgage pricing, punctual closings, and you may exceptional provider. Whenever you are finding to purchase a home throughout the Redding area or must talk about the potential for refinancing your current house mortgage, do not think twice to contact me to have a free, no-obligations quotation.

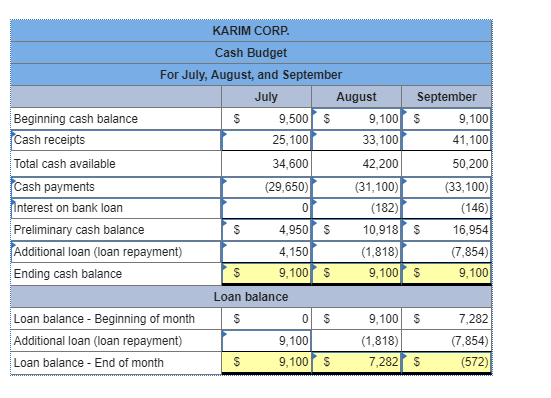

Compliant Mortgage Limits Redding, Ca

The new baseline 2024 compliant financing restrict from inside the Redding, California is actually $766,550. Listed here are your house mortgage restrictions for one to four-equipment attributes in the Redding.

Redding, Ca Mortgage brokers

Would you live in a rural community? Then your USDA home loan program is a great tool in order to think. Reduced cost, and you can great features.

Do you really or did you serve on military? Va home loan program is a fantastic substitute for envision when to find property or mortgage refinancing.

Acquiring a mortgage pre-recognition is easier than do you consider. They are the basic steps and direction to own acquiring property loan pre-recognition having a loan provider.

About three Steps For A mortgage Pre-Acceptance

- Done a credit card applicatoin form

- Complete the newest expected files

- The loan Administrator obtains a copy of credit report.

Here are Five Very first Financial Guidelines You should know

- Mortgage loan providers want to see the debt-To-Money proportion below 50%.

- If you find yourself to find a house you have to be ready to put off at least step three% (Virtual assistant lenders support good 0% down).

- Essentially, you really must have your credit rating at the or significantly more than 620.

- Residential mortgage brokers simply give to 1-cuatro tool residential properties. Five products or more is a commercial home loan.

This is important to keep in mind; every mortgage lender is different therefore remain that in mind. For people who meet up with the more than guidelines it is not a guarantee you will have a mortgage pre-recognition. There are various mortgage lenders who need a lowered debt-to-earnings ratio, a high deposit, and/otherwise a higher credit rating.

A button an element of the home loan pre-acceptance techniques is that you, the fresh candidate. Bringing perfect and you will over information is very important. Second, submit exactly what the Financing Manager is requesting, and do not substitute. If you don’t have precisely what the Loan Officer is inquiring to own, mention by using your/her prior to sending in the records.

Constantly, new pre-approval processes requires 24-48 hours doing (that is once you’ve complete the borrowed funds software and you may submitted all of the the new questioned papers).

An individual will be pre-accepted the loan Manager tend to thing your a pre-acceptance page (when you’re to acquire a home). If you’re refinancing your current mortgage, the mortgage Officer have a tendency to prepare yourself the latest file for underwriting.

Large financial company In Redding, Ca

A beneficial Redding large financial company you can trust was someone who has the ability to have the greatest home loan pricing and get will bring an advanced off customer support. A reliable mortgage broker will often have 5-a decade of expertise, the capacity to promote a number of financial programs, and you may a high rating on the Bbb, Zillow, Bing, and.

Delivering essential and you can tips to their readers is an option characteristic too. Listed here are four academic stuff I believe all the mortgage applicant would be to understand.

Domestic Assessment

This short article provide the ins and outs of the brand new Family Assessment processes. If you’re to buy a house otherwise refinancing your current financial interest rate then definitely discover my personal Domestic Appraisal post.

Domestic Review

An option element of to invest in Pleasant Valley loans a home ‘s the Home Evaluation. This will be a complete needs for all very first-day homebuyers. Inside simple-to-comprehend article, you’re getting detailed information in regards to the Home Evaluation process.

Records Needed seriously to Refinance

An enormous action to your protecting time once you re-finance your current financial try knowing what data files a home loan lender demands to refinance your residence. This simple-to-understand article can give a detailed listing of the latest files your could need to refinance the home loan.

To buy a property is going to be exhausting but it does not have any so you can feel. A good way you possibly can make they easier is by knowing ahead of time just what records the lender should underwrite your own financing. This short article make you detailed information regarding the files you must pick property.