Step one: Influence Qualifications

Before you start the application process, know if you and the house you’re interested in are eligible getting a great USDA mortgage. Use the USDA’s on line equipment to test possessions and you may earnings qualification.

2: Select a good USDA-Recognized Financial

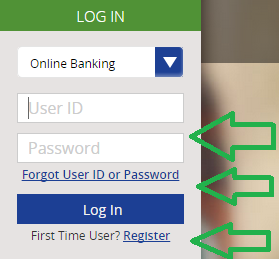

Not absolutely all loan providers and finance companies render USDA funds, making it important to come across a great USDA-acknowledged mortgage lender that is experienced in the application. Shore dos Coast is happy to help you serve Ala homeowners seven days a week, merely complete the latest Short Consult Form to get going.

3: Rating Pre-Recognized

Delivering pre-acknowledged to possess an effective USDA loan will provide you with a definite idea off exactly how much you can afford to make your a far more attractive visitors. To track down pre-acknowledged, you’ll need to give us documentation eg proof of money (w2’s, shell out stubs, taxation statements) two-years of a job record, two-many years of leasing record, and you can borrowing information.

Step 4: Pick a house

After you may be pre-accepted, you can start your house browse. Manage an agent who’s accustomed USDA financing and certainly will support you in finding eligible attributes inside the Alabama.

Action 5: Fill in The loan Software

Shortly after choosing the perfect property, you will need to finish the full application for the loan. This will involve providing extra up-to-date files and guidance because the expected from the bank.

Action six: Household Assessment and you may Assessment

The lending company tend to order an assessment to determine the property value the property. Likewise, a house examination is advised to understand any potential problems with the house. The newest assessment ensures that the home meets USDA advice and that is really worth the price.

Step 7: Underwriting and you can Recognition

Just like the assessment and you may examination are over, the application will go through underwriting. In this phase, the financial institution usually remark all your records and you may be sure your own qualification. When the everything you reads, you get latest financing recognition.

Step 8: Closing

Once receiving recognition, possible proceed to the new closing stage. Throughout the closing, you can easily indication all necessary data, pay any closing costs, and you will finish the loan. Given that papers is complete, you get the newest keys to the new domestic!

USDA Financing Faqs (FAQs)

USDA loans are often used to get all types of properties, in addition to single-family relations home, condos, and you may are manufactured home. The house have to be situated in an eligible outlying area and you can serve as the majority of your home.

Can i explore an effective USDA financing to refinance a preexisting financial?

Sure, the latest USDA also offers refinancing choice, including streamline and you will non-improve refinance applications, to greatly help people straight down their interest costs and you may monthly installments. You should currently have a good USDA mortgage to help you re-finance which have USDA.

Exactly how much is the closing costs that have USDA funds?

Settlement costs and you may prepaid escrows having fees and insurance coverage are usually 3%-5% of cost. USDA allows the home provider to fund the buyer’s closing will set you back. Customers also can roll inside their settlement costs to their financing, assuming the new house’s appraised really worth is sufficient to support it.

Are there costs in the USDA?

The bodies backed loans wanted a single-big date initial make sure percentage and you can FHA and you may USDA money likewise have a month-to-month (PMI) charges. Brand new upfront payment is normally step one% of the amount borrowed, since yearly payment (month-to-month financial insurance coverage) was 0.35% of original site loan balance. The step one% up front commission would be folded for the amount borrowed.

How long does the new USDA financing acceptance process get?

New closing processes in Alabama usually takes a month, based on circumstances for instance the lender’s loan volume, the new complexity of application, and the big date needed for new assessment and assessment.